The NFT craze has taken over the globe in 2021. This was a big breakthrough year – in 2021, the NFT market grew around 25000%, from $94.9 million in 2020 to a staggering $24.9 billion the following year.

However, NFTs were introduced to the general public back in 2014, when Kevin McCoy and Anil Dash created a piece of digital art (in this case, a video clip) in the form of NFT. They themselves admit that the audience didn’t really understand what they were talking about, but over time, it seems like this lack of understanding and excess skepticism are starting to fade.

The recent rapid rise of NFTs is probably due to several interconnected factors, such as the COVID pandemic, growth of the cryptocurrency market, as well as the inability of digital artists to sell their work and make a living.

Finally, one of the biggest appeals of NFTs is the new possible applications that could, in theory, have a significant effect on the whole array of different markets and on society as a whole. Some of them are already here, some of them are around the corner, and some of them are surely yet to be discovered. But before that…

¿Cómo funcionan las NFT?

NFT is a crypto-asset

NFTs are a part of the crypto financial ecosystem. They exist on a blockchain and in order to buy them you’ll need a crypto wallet and some crypto coins, and if you want to sell them you can only charge in cryptocurrency. There’s no fiat money or centralized financial institutions involved in trading.

However, NFT is not exactly a cryptocurrency because, first of all…

NFTs are not fungible

The main characteristic of the NFTs is that their design and value are unique, and they can’t be just replaced with a token of the same “currency”. For instance, one coin of ETH is the same in value and in properties as any other coin of ETH, but every NFT has unique properties and can’t be converted to each other in the way a regular cryptocurrency can.

(Disclaimer: this doesn’t mean you can’t in theory trade an NFT for another NFT, but the financial value assigned to an NFT comes only from the buyer or the seller. There’s no exchange platform that would strongly suggest or predetermine their current value, like in the case of cryptocurrency. Simply, NFTs are a different type of thing.)

Hence, NFT is a non-fungible token, and that’s where the name comes from. Structurally, NFTs differ from cryptocurrencies because they carry some additional metadata that makes them different from coins and distinguishable from each other. They also rely on a special protocol (ERC-721), that uses some new functions for smart contracts so that the blockchain can recognize the property of uniqueness for every NFT.

NFT represents a digital item

Now we get to the point that made NFTs a global hit. Unlike a cryptocurrency token that always represents a class of identical coins, NFTs can represent unique items and that’s where their strength lies.

These unique items can be anything digital – from a music album to a .gif image. And when we say anything, we mean anything, including your scanned Geography test from elementary school or a job contract.

It’s important to remember that NFTs, strictly speaking, are not digital items that they represent. To put it simply, they’re basically just lines of code that prove your ownership of a particular digital file. NFTs only include a link to this item and digital proof that you bought the item.

Usually, when we talk about NFTs, we basically talk about buying and selling digital art. It’s not the only application of the NFT technology, but it’s still the broadest and most popular one. We’ll circle back to this topic to see how it works in more detail later on.

Benefits of running on a blockchain

Just like in the case of cryptocurrency, all transactions and transfers happen on a blockchain. This ensures decentralized control and validation of transactions which makes it very resistant to hacks and all kinds of security issues. And as time passes, blocks of transaction info created by the blockchain get exponentially more difficult to change or revert.

Of course, no system is completely foolproof, but in theory, for most blockchains (at least those that use the proof-of-work system), you’d need to control 51% of the nodes in the entire system in order to cheat that system. This is because the authority to validate transactions is distributed among the nodes that independently check blocks of info and “report” back to the system.

This way there’s no single server or component that confirms and handles transactions, so there’s no fear that the whole system will collapse if one of the components fails or gets hacked. This makes it much more secure than the traditional centralized control systems.

It’s important to emphasize that NFTs can’t be traded on every blockchain. Some of them don’t support smart contracts or don’t use the ERC-721 protocol, which makes them incompatible with NFTs. Among the most popular blockchains that support NFT functionality are Solana, Ethereum, Cardano, and Tezos.

NFTs in art

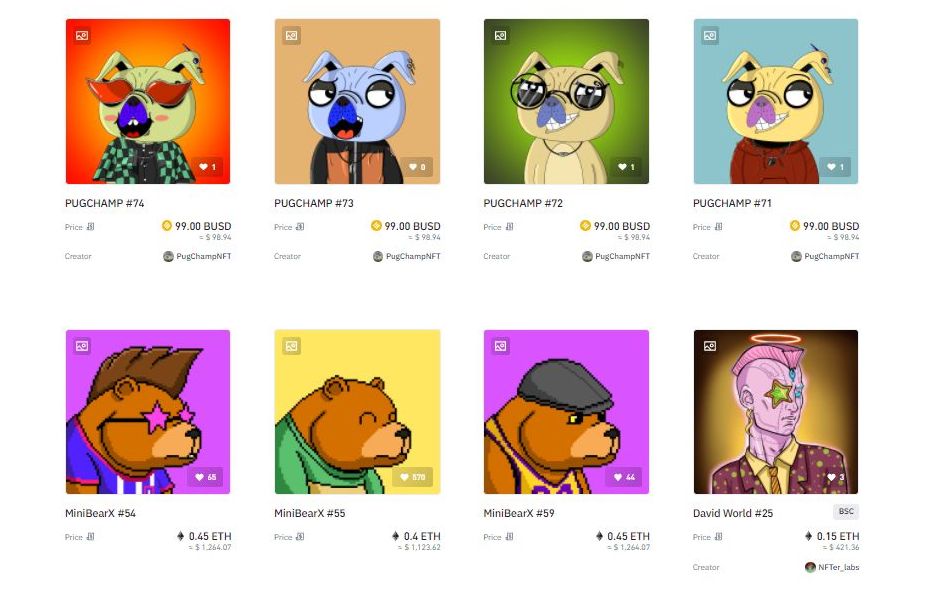

As we’ve mentioned, the dominant application of NFTs is in trading digital crypto art. So how and where does the trade happen?

How to trade NFTs?

It’s actually pretty simple. Anyone with a crypto wallet and enough coins to pay for the fees of minting an NFT (“gas fees”) can actually create an NFT from their digital art. And as for “where”, the trade happens at online marketplaces that offer NFTs, such as OpenSea, Rarible, Mintable, or ojos digitales. More and more often, the NFTs can be found in different auction houses where they’re sometimes sold for massive amounts of money.

The process of buying and selling is pretty straightforward as well, and it works more-less like any other crypto transaction. If you’re selling – you sell the item (often via an auction), pay the marketplace a small percentage, and take the rest of the money. If you’re buying, you just transfer the money and soon you’ll receive the desired NFT in your wallet.

Benefits of running on a blockchain

Just like in the case of cryptocurrency, all transactions and transfers happen on a blockchain. This ensures decentralized control and validation of transactions which makes it very resistant to hacks and all kinds of security issues. And as time passes, blocks of transaction info created by the blockchain get exponentially more difficult to change or revert.

Of course, no system is completely foolproof, but in theory, for most blockchains (at least those that use the proof-of-work system), you’d need to control 51% of the nodes in the entire system in order to cheat that system. This is because the authority to validate transactions is distributed among the nodes that independently check blocks of info and “report” back to the system.

This way there’s no single server or component that confirms and handles transactions, so there’s no fear that the whole system will collapse if one of the components fails or gets hacked. This makes it much more secure than the traditional centralized control systems.

It’s important to emphasize that NFTs can’t be traded on every blockchain. Some of them don’t support smart contracts or don’t use the ERC-721 protocol, which makes them incompatible with NFTs. Among the most popular blockchains that support NFT functionality are Solana, Ethereum, Cardano, and Tezos.

NFTs in art

As we’ve mentioned, the dominant application of NFTs is in trading digital crypto art. So how and where does the trade happen?

How to trade NFTs?

It’s actually pretty simple. Anyone with a crypto wallet and enough coins to pay for the fees of minting an NFT (“gas fees”) can actually create an NFT from their digital art. And as for “where”, the trade happens at online marketplaces that offer NFTs, such as OpenSea, Rarible, Mintable, or ojos digitales. More and more often, the NFTs can be found in different auction houses where they’re sometimes sold for massive amounts of money.

The process of buying and selling is pretty straightforward as well, and it works more-less like any other crypto transaction. If you’re selling – you sell the item (often via an auction), pay the marketplace a small percentage, and take the rest of the money. If you’re buying, you just transfer the money and soon you’ll receive the desired NFT in your wallet.

Propiedad de NFT

Once you buy an NFT, you may ask yourself “do I really own this artwork?”. It’s a very tricky question as literally anyone can visit the link and use the right-click to download the artwork that you paid for. But it still doesn’t mean it belongs to everyone.

Let’s use an analogy to better explain this. You can spend millions of dollars on an original Picasso or $20 on a print. There are probably millions of people in the world who have the same painting of Picasso hanging from their walls – but everyone knows they’re just copies. And it doesn’t affect the price nor the huge artistic and cultural value of the original.

It’s the same with NFTs. NFTs are the proof, issued basically by a blockchain, that you own a piece of art. Just like you get the confirmation from an auction house that your Picasso is real. Doing the same with digital art may still sound weird, but it’s really no different from “real-world” art trading.

NFTs and copyright issues

By just owning an NFT, you don’t own any legal exclusive rights to it. These rights can be defined by a separate agreement, but an NFT is a sort of internal proof that you own something, which doesn’t automatically prevent others from using its copies. At least in the legal framework we’re using at the time.

Also, an artist can sell a whole array of identical images as separate NFTs. And this does sometimes happen, as not all NFTs are completely unique – some are just limited to 5, 10, or 150, or to any number of copies. They’d still be unique entities on a blockchain, but they would, in reality, refer to the same image.

However, in practice, artists always reveal in advance just how scarce their NFT is going to be, as this factor substantially affects the price. It’s uncommon to “hide” this from the buyers, at least for renowned artists who don’t want to risk their credibility this way.

Benefits of NFTs for artists

NFTs could revolutionize the way we experience and consume art, but they can help artists even more. There has always been a shortage of interest and methods to buy digital art, and NFTs are a great way to support someone’s work.

Moreover, artists often automatically get a percentage from later resales. So if one of their works gains a lot of value over time, they’ll get a chunk of that money and won’t remain completely empty-handed.

Of course, there are also benefits for buyers, collectors, and resellers, as they can all make some decent money if they play their cards right and purchase NFTs that will quickly increase in value. Some of them were already sold for millions of dollars and it seems like this is only the beginning.

NFTs in video games

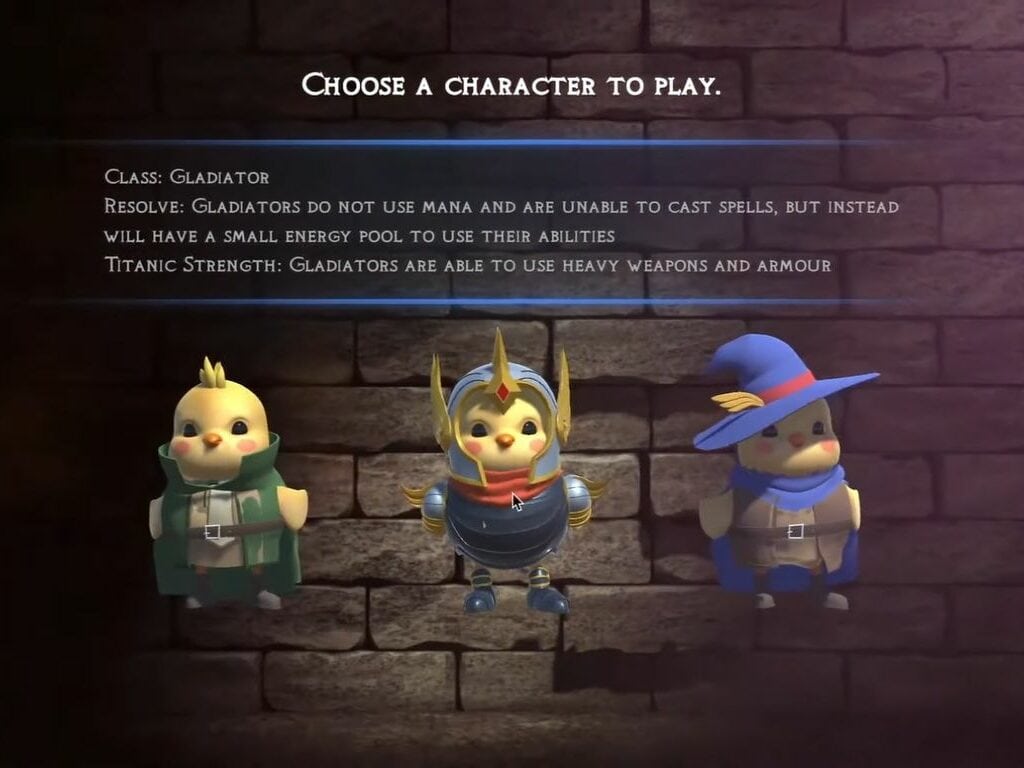

Another area where we can see powerful applications of NFTs is video games, known also as crypto games. Most of the NFTs sold in video games are basically artwork that can be utilized in these games, but that’s far from the whole story.

NFTs as in-game items

The simplest use of NFTs in games are tradable in-game items, such as skins, weapons, armor, pieces of clothing, or even entire characters. These can be traded on a marketplace specialized for a specific game or on external marketplaces.

The best trick with NFTs as game elements is that they are transferable between different games, if a particular game studio allows it. Sometimes they need to be modified a bit in order to be compatible with the new surroundings and the new ecosystem, but it’s doable. And the whole idea behind it is that you own an in-game item, and you can do whatever you want with it – sell it, keep it, or play another game using it.

NFT games run on a blockchain, so they also have an additional layer of security against all sorts of scams and breaches. This is hugely important because NFT games can bring players money in a number of different ways (which is the topic we’ll get to in a second) and protecting their assets properly is a must.

NFTs as virtual real estate

The whole Metaverse sensation has got a lot of attention and also opened a lot of new opportunities for implementing NFTs. Some open-world RPG games give you a lot of freedom to explore the particular virtual world and interact with it (and other players) in new ways.

In some of these games, you can buy parcels of land and build houses and other objects on them. These parcels of land are usually sold as NFTs and they’re likely to get really expensive in the following years.

It’s also very appealing that you can in theory move your in-game possessions (or entire homes) from one virtual world to another, which could generate some sort of competition between different worlds. We can expect game developers to offer different benefits for players who choose their virtual reality over their competitors’.

Here you could even use NFTs that initially had nothing to do with the game you’re playing. For instance, if you bought a digital drawing and you keep it in your crypto wallet, you can import it into the game and put it on the wall of your home. Putting these cross-game functionalities to work today is not so easy, but it could become a routine practice in the near future.

Earning money in NFT games

NFT games are attractive for one other reason – financial incentives. You can actually earn money playing some of these games (that’s why they’re called play-to-earn games), and the most successful players have sold their in-game NFTs for hundreds of thousands of dollars. Here are some of the different ways to make money in NFT games:

- Trading high-value NFTs that you previously bought or won

- Combining existing NFTs to create a new, more valuable one (often through breeding or forging), and then selling it

- Completing missions and quests itself can also put coins into your wallet as a reward

- Winning in tournaments and competitions against other players

- Staking your coins inside of a game for a fixed amount of time

What does the future bring for NFTs?

As it was mentioned, one of the advantages of NFTs is that they can represent basically any digital item. In addition, it’s a proof of ownership that’s almost impossible to hack so it could be utilized for many legal uses.

You could, in the future, store your diploma or a purchase agreement for your house this way. In fact, any important document you possess may be represented by an NFT in order to make it more secure and accessible.

Some other areas that could benefit from NFTs in the future include advertising, healthcare, law, patents and intellectual property, logistics, ticketing, clothing, and much more.

All in all, there are some big plans for NFTs among experts and enthusiasts, but there’s also some skepticism as we’re still not sure about the risks and challenges that NFTs could bring. Also, we still need to see how NFTs work on a bigger scale, in terms of security, energy consumption, and legal frameworks for their mass usage. In light of these facts, whether or not NFTs will turn out to be the most practical solution for mentioned issues remains to be seen.